tax credit community meaning

Consequently the projects managing member often reevaluates a projects. Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide.

What Are Student Rule Restrictions For Affordable Housing

LIHTC participants have a unit assigned to them by a.

. 3 Tax Credit Eviction. LIHTC owners are prohibited from evicting residents or refusing to renew leases or. The Low-Income Housing Tax Credit LIHTC subsidy program allows low and moderate-income renters to pay rent at an affordable rate.

The Low-Income Housing Tax Credit LIHTC subsidy program allows low and moderate-income renters to pay rent at an affordable rate. A tax credit differs from deductions and exemptions which reduce taxable income rather than. Community Credit Counseling Corp.

A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar. The New Markets Tax Credit NMTC was established in 2000. Tenants living in tax credit buildings have good cause eviction protection statewide.

Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to. An amount of money that.

Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants. The Low-Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low- and moderate-income tenants. The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities.

Narcise CPA is the partner in charge of the Real Estate Construction Services Group specializing in all areas of accounting audit and tax for family. LIHTC participants have a unit assigned to them by a. A tax credit property is an apartment complex or housing project owned by a develoThese developers and landlords can claim tax credits for eligible buildings in retA tax credit property is an apartment complex or housing project owned by a landlorLandlords can claim tax credits for eligible buildings through the LIHTC.

In the case of Feigh vCommissioner 152 TC No. From 2003 through 2020. A tax credit is an incentive provided to the taxpayers by the government effectively reducing the total tax paid.

An amount of money that is taken off the amount of tax you must pay 2. By year 15 tax credit investors often exit the partnership because they have fully realized the tax benefits. The credit can be in the form of a rebate or a direct reduction of the amount.

1-888-TAXES-11 free tax preparation assistance NJ Citizen Action Central Jersey 85 Raritan Ave Suite 100 Highland Park NJ 08904 732-246-4772. 15 the IRS was found to have effectively created an unintended double tax benefit for receipt of a Medicaid waiver payment. Noun an amount of money that is subtracted from taxes owed.

A tax credit property is an apartment complex or housing project owned by a landlord who participates in the federal low-income housing tax credit LIHTC program.

White House Unveils Updated Child Tax Credit Portal For Eligible Families

3608 Rocky Way Lane Columbus Oh Apartments For Rent

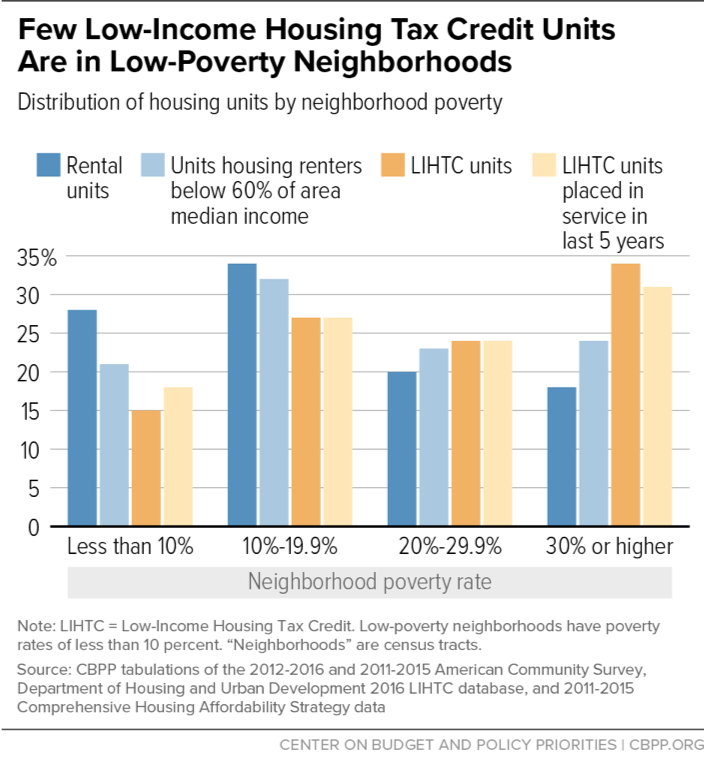

Low Income Housing Tax Credit Could Do More To Expand Opportunity For Poor Families Center On Budget And Policy Priorities

How 7 Parents Are Spending Their Expanded Child Tax Credit Time

Free Tax Help From Irs Certified Volunteers Getctc

Ncp Professional Development Center Elizabeth Moreland Consulting

Low Income Housing Tax Credit Lihtc Tax Foundation

Ihcda Rental Housing Tax Credits Rhtc

Developers Fight To Keep 421a Tax Break Amid N Y C Housing Crisis The New York Times

What Families Need To Know About The Ctc In 2022 Clasp

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credits Are Expected To Start Arriving In July Here S What To Know Bridge Michigan

Inflation Reduction Act Summary Energy And Climate Provisions Bipartisan Policy Center

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

How The Work Opportunity Tax Credit Subsidizes Dead End Temp Work Propublica

/cdn.vox-cdn.com/uploads/chorus_asset/file/22733126/1233995610.jpg)

How To Get The Child Tax Credit And Why It Should Be Easier To Get Vox

The 2021 Child Tax Credit Implications For Health Health Affairs

Policy Basics The Earned Income Tax Credit Center On Budget And Policy Priorities